WealthProbe: The product that will help you examine your nest egg based on your circumstances - without depending on any general rules-of-thumb

The downloadable feature and user-friendly interface enable you to easily analyze your most sensitive financial information in the context of your unique situation, while remaining in the comfort and security of your own home. In addition, WealthProbe allows for easy what-if analysis, allowing you to examine several variations of hard-to-know assumptions about the future.

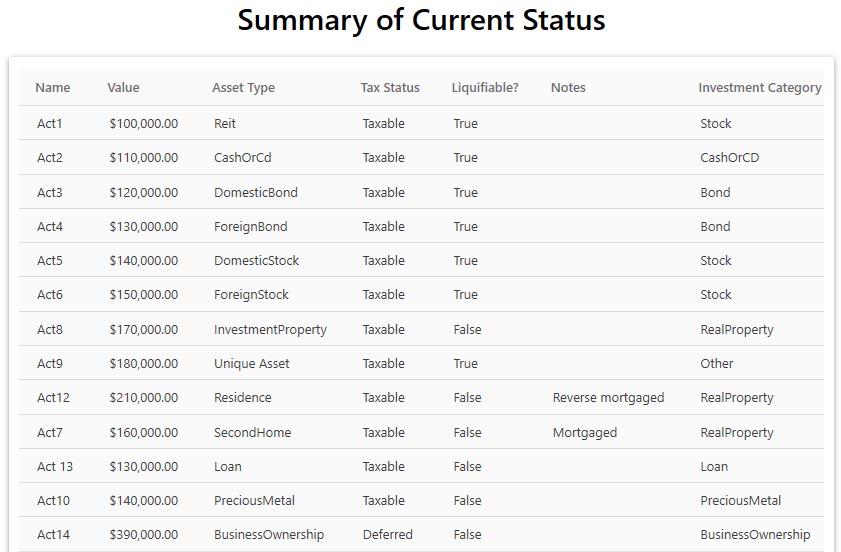

Summary of Current Status:

WealthProbe has been programmed to give you maximum flexibility throughout. As an example, WealthProbe allows for several different asset types, as shown in this listing. Individual assets and accounts are entered as one of the asset types shown. You can enter as many assets as you want for any asset type except one - you can have only one Residence (any number of other properties can be input as a 'SecondHome' or an 'InvestmentProperty'). Also note in this example that there is an asset type the user has called ‘Unique Asset’. This is an asset type the user has decided does not fit into any of the standard WealthProbe asset types, for example, you might call your unique asset type ‘Collectibles’. As with the other asset types, you can input as many individual assets as you want in your Collectibles asset type, e.g. coin collection, a work of art, an antique car, etc. Unlike the standard asset types, you will determine whether your unique asset type is volatile or not, and whether each asset in your unique asset type is readily liquifiable or not.

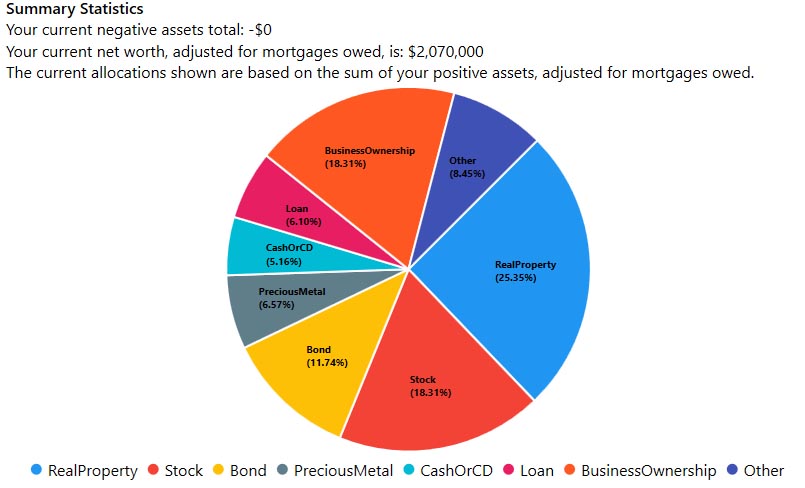

Summary Statistics:

The pie chart depicts how this user is currently invested across the WealthProbe ‘Investment Categories’. These categories contain one or more asset types. For example, the ‘RealProperty’ investment category contains the Residence, SecondHome, and InvestmentProperty asset types. Later you will use these Investment Categories to enter the allocations and returns (your investment plan) WealthProbe will use to calculate your wealth as a function of time. Since this scenario had a ‘Unique Asset’ the user determined didn’t fit into an existing investment category, it became its own investment category called ‘Other’. So 8.45% of this user's current assets are in invested in the ‘Other’ investment category representing the user defined ‘Unique Asset’ asset type. The summary just above the pie chart shows the net worth of the user at the time data was input into WealthProbe, adjusted for negative accounts and mortgages. Asset values in the pie chart have been adjusted downward for the mortgages owed.

WealthProbe explores your estate based on your desires and inputs.

Your assessment of how long your nest egg needs to last

Your current and planned income

Your current wealth by asset type

Your Tax-Deferred and Tax-Exempt IRAs

Your assumptions

Your current and expected expenses (simple or a budget, the level of detail is your choice)

Your future investment allocations and estimated returns

Five distinct phases to allow flexibility in planning the approach to your retirement

Common Questions:

Can I change my inputs in order to do ‘What if’ analysis?

Once you complete a scenario, most of your inputs can be changed allowing what-if analysis. You can even re-load the data file of a completed scenario and do what-if analysis on it. Once you have made the changes, WealthProbe will show you the effect of the changes on your outcome.

How long will my income and assets last?

You provide your current and planned expenses, current assets, investment plans, current and planned income streams, and certain assumptions such as rates of return and inflation. WealthProbe uses this information to calculate your total wealth on a month-by-month basis. This information is output in the Results section. In addition, WealthProbe tells you the date you run out of money if that happens before your Target Date (the date to which you plan to need your wealth). If you make it to your Target Date, WealthProbe provides your net worth at the Target Date, and continues calculating to the date your wealth runs out. If your wealth will last until your 120th birthday, WealthProbe shows the net worth of your estate at that point.

What about the security of my information?

The only time WealthProbe needs to be connected to the internet is upon first usage on your device. This is to activate the license to use the software on that device. After that, no external communication takes place between WealthProbe and the outside world, except if you need to reactivate WealthProbe (when, for example, you replace your previous device) or when you elect to download an update. In fact, you can disconnect your computer from the internet if you wish while using WealthProbe. When you enter your data into WealthProbe, your data files are encrypted and stored on your own device or detachable drive. Only your device has the encrypted key to unlock these data files when you need them again.

When can I realistically retire?

After WealthProbe performs its calculations based on the data and plan you input, if you do not make it to your planned Target Date, WealthProbe will tell you the year you run out of money and gives suggestions on how to change your plan, including working a little longer. The ‘what-if’ analysis feature allows you to change individual inputs, allowing you analyze your new plan as needed.

Will I run out of cash? If so, when?

WealthProbe tracks your cash, and assets that are readily convertible to cash, in order to monitor your ability to pay the bills. If you will run out of cash, WealthProbe tells you when and shows you a listing of all your available non-liquid assets. You will choose one of these assets to liquidate and give your estate a cash infusion. This will happen as often as necessary until you either run out of assets or make it to your Target Date. WealthProbe gives a summary of the non-liquid assets you chose to liquidate, and when you needed to liquid them, as part of the final report in the results section. This listing gives you useful planning information pertaining to when you may need to consider selling individual assets in the future.

How can WealthProbe help my executor or trustee?

WealthProbe provides a summary of the name, asset type, and current value of all the assets you input – WealthProbe never asks for account numbers or passwords, thus cannot list them. However, the summary it provides is a single place for your executor to go to find a listing of all your assets. This eliminates the requirement for the person in charge of your estate to painstakingly search your records trying to locate all of your assets, and potentially missing some of them.

How does WealthProbe increase my financial freedom?

Prior to retiring, most people are focused on saving as much as they can for retirement. Once they retire, this suddenly changes. Instead of saving, most people must start spending down their nest egg. During retirement, options for spending money are constantly arising, such as traveling, buying a boat, or helping a relative financially. Many retirees find it hard to spend this extra money, fearing how it might affect their ability to fund their retirement years. They might avoid a great trip abroad because they don’t want to spend the money without knowing the degree of impact on their finances. WealthProbe shows the effects of spending money on these types of non-essential items. Running the option through WealthProbe will show its impact on the user’s wealth results. By having the facts, the retiree has gained the freedom of making an informed decision – and possibly the freedom to enjoy their hard-earned retirement years more fully.

What if my situation isn’t typical?

An analysis in the September 12, 2022 edition of the Wall Street Journal found that the assumptions used by most retirement-income calculators (e.g. assuming people are in good health, they don’t want to make any bequests, they will claim Social Security as soon as they retire, plus other ‘typical assumptions’) are not assumptions that represent the typical retiree. When it comes to retirement planning, one size does not fit all. Among many other capabilities, WealthProbe allows you to account for your health in determining your Target Year; not only allows for bequests, but allows them to be started and stopped according to your wishes while offering you 5 different disbursement frequencies of to choose from; and you can start your social security any time you like. As you investigate, you will find this just scratches the surface of the flexibility you will find inherent in WealthProbe. In fact, WealthProbe analyzes your own unique situation without using any ‘typical’ retirement rules-of-thumb.

Operating System Note

WealthProbe is compatible with devices using all Microsoft-supported versions of Windows 10 and later. If you are operating an earlier version of Windows, we recommend upgrading your operating system before installing WealthProbe.

If you are an Apple user and think you might be interested in WealthProbe, we will notify you when the Apple compatible version becomes available, if you like. Please use the link: Apple Users and indicate that you are an Apple user in the subject line.”