Life is an incredible journey.

Retirement is an important part of it.

Use WealthProbe to explore your retirement plan.

Life is an incredible journey.

Retirement is an important part of it.

Use WealthProbe to explore your retirement plan.

WealthProbe Summarized

WealthProbe provides an accurate and affordable way to explore your retirement goals and progress for estates of any size. It is especially helpful for those who don’t want to pay for a financial advisor, or those who want a second opinion. Spend less time and money to examine the results of your unique retirement plans using WealthProbe.

Wealth Probe allows for both Traditional and Roth IRAs, either inherited or belonging to the original owner. This treatment incorporates the changes in the recent SECURE acts. See our Feature Summary for a general listing WealthProbe's capabilities.

Retirement Planning

Plan when you can realistically retire.

Run While Offline

Securely examine your unique retirement needs in your own home.

Help your Executor/Trustee

Provide a summary of assets in one convenient secure place.

Your Financial Freedom

WealthProbe can help you decide on spending decisions like whether you can realistically take a trip or give a gift to a loved one.

Easy and Powerful Personal Financial Software

Fee-based advisors focus on portfolio construction and general rules of thumb as the basis for retirement analysis. WealthProbe offers an alternative by analyzing your unique situation using in-home software focused on goal-based planning by examining both your current and planned investment and spending patterns.

Setup Software

Easily download and install the latest version of WealthProbe to your computing device. Install updates for free for the duration of your license.

Easy to Use

User-friendly interface for data entry. Internal data verification to guard against inadvertent or mistaken data entry. In-code Help section to assist your preparation for each section, answers frequently asked questions, and offers a glossary of phrases and terms. Each WealthProbe section also contains optional additional help buttons to answer questions as they arise.

What-if Analysis

Allows you to change inputs in previously completed sections, enabling you to see how these changes will affect your final results.

WealthProbe Delivers

A complete summary of all your data inputs and key assumptions. Your current net worth and a graphical summary of your current asset allocations. A graph of your cash flow activity to include which non-liquid assets you will need to convert to cash and when. A detailed graph of your net worth as a function of time.

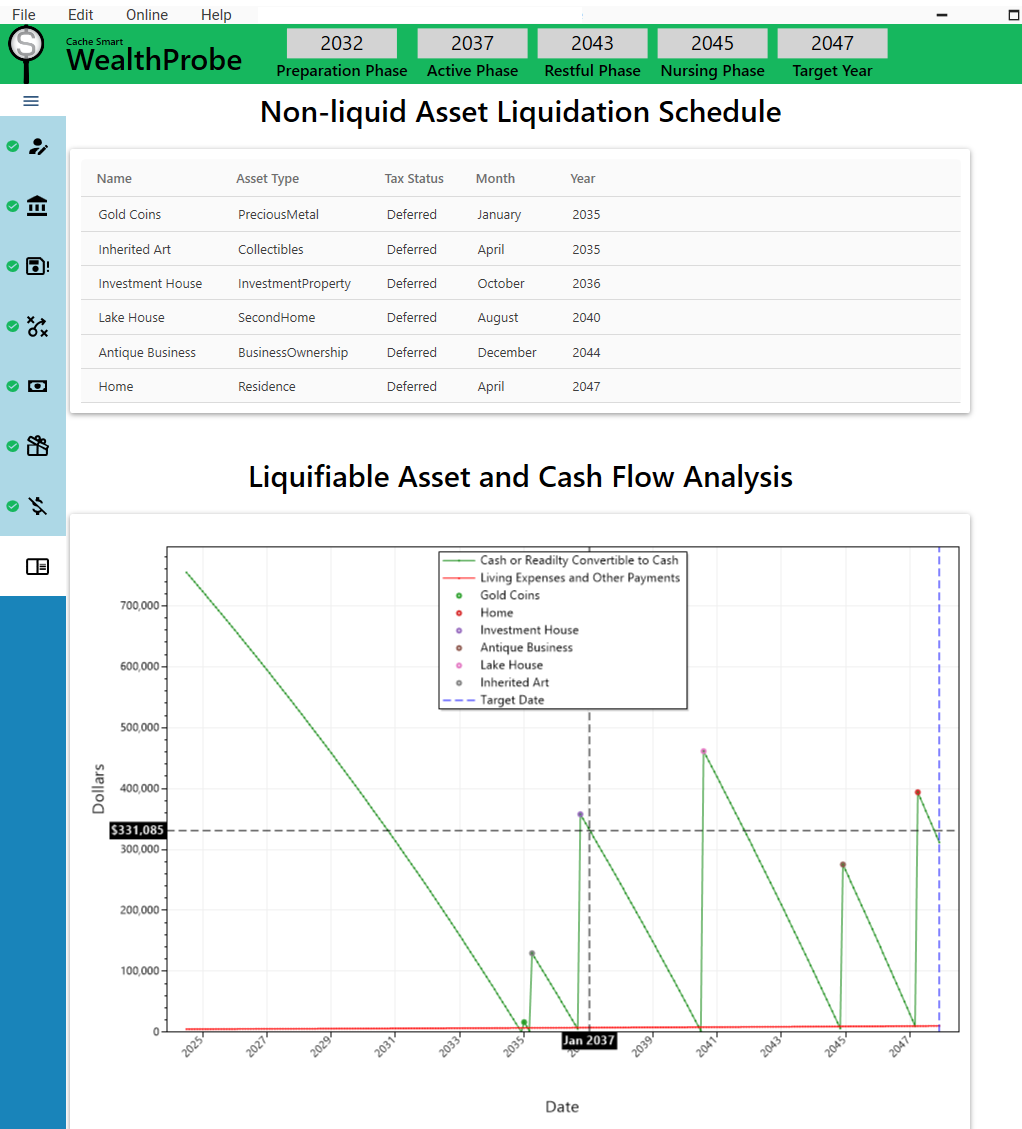

Cash Flow Analysis

This chart shows the result of a simple scenario designed to illustrate WealthProbe’s analysis of cash flow. Your ability to pay all expenses is monitored on a month-by-month basis. This curve looks much different than the next one since it is focused only on cash available to pay the bills. If you run out of cash from savings and income, and have no more assets that are readily convertible to cash, WealthProbe will bring this to your attention and list all of your non-liquid assets. It’s up to you to choose which asset to sell each time this happens. When a non-liquid asset is sold, the available cash suddenly increases by the value of the asset when it was liquidated. In this scenario, the user chose to liquidate the non-liquid assets in the order shown in the Liquidation Schedule. This schedule allows the user to plan head and prepare for the need to sell each non-liquid asset. In this particular case the user makes it to their Target Date of December 2047, but needs to sell their home in April of that year to get through the year. The user might decide this is acceptable by planning to move in with a friend or relative. Or they might decide to make some changes to their current plans (perhaps working a bit longer or cutting planned expenses) so that they can make it to their Target Date without the need to sell their house at all. Wealthprobe is designed to allow for easy ‘what-if’ analysis so the user can investigate all their options. Note that the cursor has been placed on the cash curve corresponding to January 2037, the first month of this user’s retirement, showing the corresponding amount of cash and readily liquifiable assets available at that time. The amount of cash and liquifiable assets available, or the expense at any particular month, can be shown by positioning the cursor over the relevant date on the appropriate curve during WealthProbe execution.

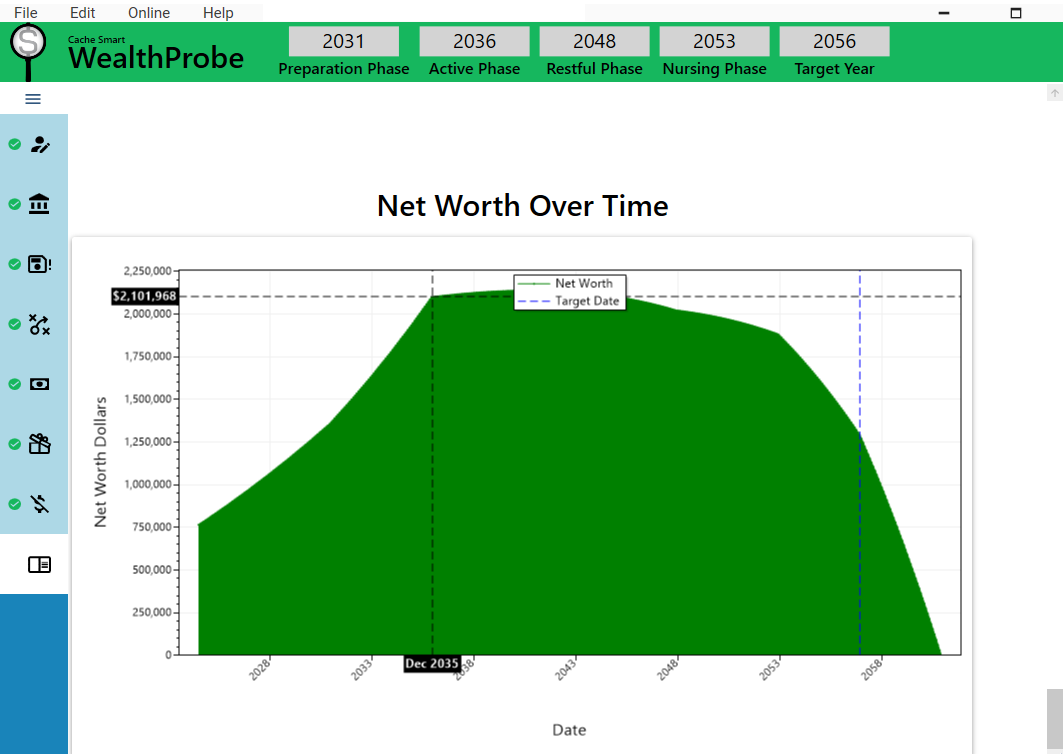

Net Worth Analysis

This shows an example of the monthly Net Worth as a function of time, one of the results shown by WealthProbe. This scenario is different from the previous one, with a Target Date of December 2056. Notice the net worth escalates at an increasing rate during this user’s working and preparation phases (due to raises) until the user stops working in December of 2035, just before retiring in January 2036 (the start of their Active retirement phase). This user assumes expenses will decrease in their Restful phase (starting 2048) so the net worth decreases at a slower rate in than in the previous Active phase. The user then assumes the Nursing phase (starting in 2053) will be much more expensive. This user makes it to their Target Date when the estate is worth almost $1.3 million, a nice estate to leave to the heirs of the estate. The cursor has been placed on the month before retirement, showing the calculated value of the estate at that time. The estate value at any month can be obtained by placing the cursor on the top of the curve at the desired month during WealthProbe execution. WealthProbe continued the calculation past the user’s Target Date and found that, given the user’s inputs and assumptions, the estate would last until December 2060.